What’s Weighing on Brokers in 2025?

Written by Team 365 Finance

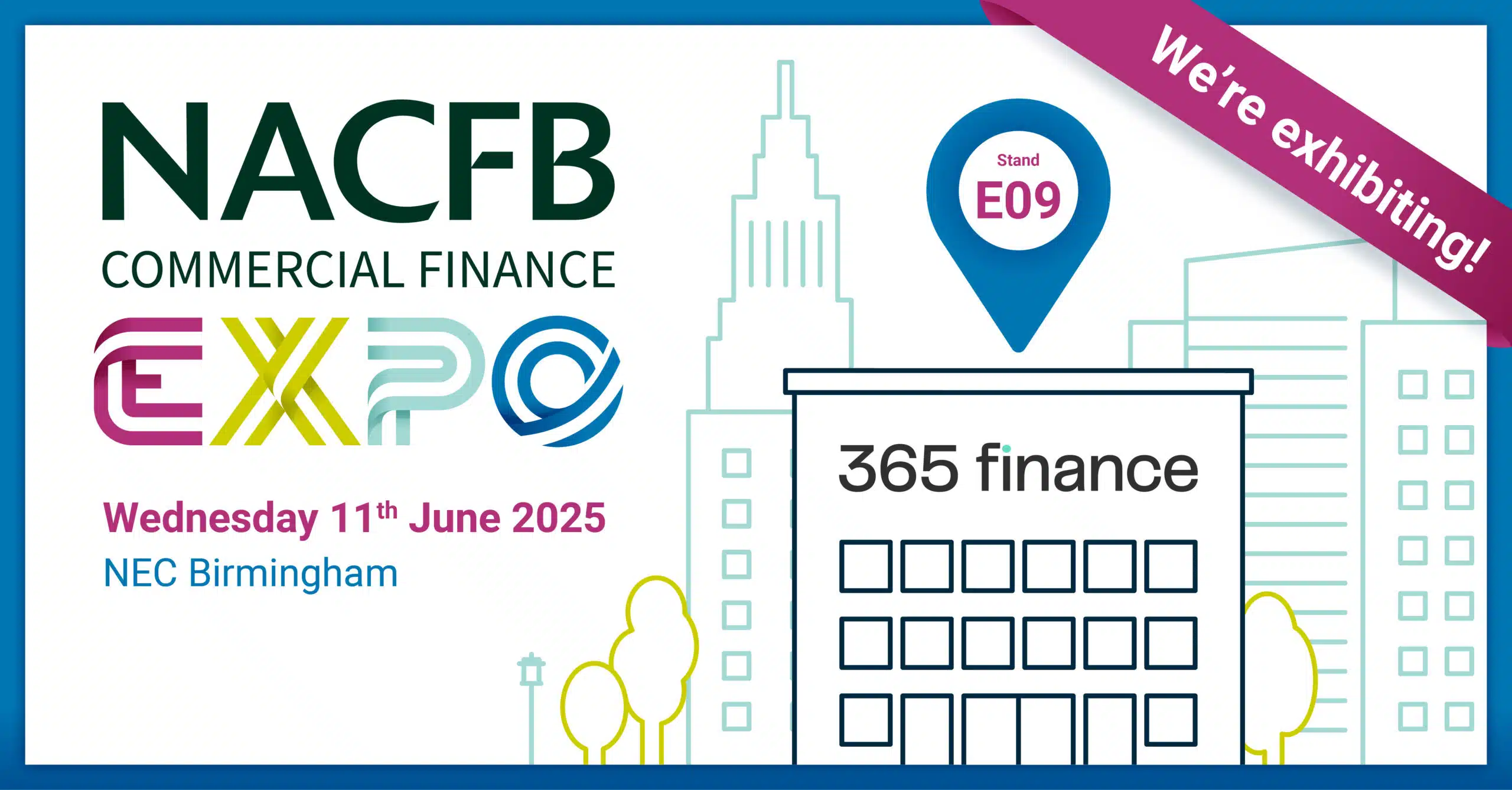

On the 11th June 2025, the 365 Finance team will be heading to the NEC in Birmingham for the NACFB Commercial Finance Expo. It will be a great chance to meet our partnerships team, learn more about how we support brokers and get up-to-date on the latest industry trends.

If you’re attending, you can find us at Stand E09.

————————————————————————————————————————————————————————-

Working in the financial industry means constantly keeping on your toes and being agile. In 2025, you can expect a lot of challenges that could result in unforeseen problems if you aren’t ready for change.

For brokers, it’s important to keep up to date with the industry as it can play a big part in how you approach your business strategies and operations.

In this article, we’ll discuss some of the main topics that may be weighing on your mind, including things like AI, relationships with lenders and regulatory pressures.

How Brokers Are Feeling in 2025

The NACFB recently published its 2024 impact report, which included an extensive survey of its members. From the survey results, you can get a good idea of the general feelings within the industry.

Some of the key stats from the report that were most interesting to us include:

- 21% of brokers find maintaining client relationships a top problem

- 18% found coordinating with lenders on terms a major challenge

- 15% were concerned about adapting to regulatory change

- 21% said that stricter lending criteria would affect their business

It was also interesting to see that only 33% of brokers diversified their offerings in 2024, while 55% maintained their existing services. As we get further into 2025, we believe that diversification will become critical for brokers in the current financial landscape.

Through successful diversification, brokers can add more products and services as well as focus on more specialised services. Although a niche approach can sometimes be lucrative, it’s wise not to have all your eggs in one basket. By offering a wider range of services as a broker, you should be able to mitigate some of the issues highlighted in the survey, as you’re not so heavily reliant on a smaller scope of business.

Top Issues Facing Brokers in 2025

As a broker, it may feel like there’s a never-ending set of challenges. But the sooner you are aware of them, the sooner you can come up with solutions to adapt and thrive.

From conversations with our broker network, here are some of the main challenges you may face and should be aware of.

Increasing Use of AI

We’re all being bombarded with AI-driven tools that promise to speed up our work and free up our time. While AI has the potential to make our jobs easier, it can also be a significant cause of anxiety.

We know a lot of brokers are wondering whether AI in financial services will replace human relationships or cut out the need for brokers entirely, but we don’t think this will ever be the case.

At 365 Finance, since launching our AI underwriting tool in 2024, we have maintained a 90% approval rate from brokers. What could sometimes be a lengthy process involving a lot of back and forth has been cut down to as little as 24 hours. By processing deals quickly, we have helped our brokers streamline the deal process so they can start on the next one.

As AI continues to grow and improve, we see it as a complementary tool but certainly not a replacement for the human support that small business owners need when looking for funding.

Regulatory Concerns

We work in a highly regulated business, so changes are a given. But, it seems that in the last few years, regulations have become even tighter for brokers and lenders.

With more stringent requirements, the introduction of new policies around AI and cybersecurity, as well as the industry’s move to full commission disclosure, these are all things that are completely new for brokers and will take up a lot of time and resources to ensure you are compliant.

It can also sometimes feel like brokers are expected to be experts in all areas of regulation, which would of course be impossible. However, with support from lenders, we can help to ease that burden.

At 365 Finance, we work hard to keep up to date with changing regulations and regularly communicate with our pool of brokers to ensure we’re all on the same page and doing the best we can for small business owners.

Service Levels

Another concern that was prominent in recent reports is service level. As a broker, getting hold of lenders can sometimes be a challenge, especially if you don’t have a specific point of contact or account manager within the company.

When you aren’t able to build relationships with lenders, it can make it difficult to agree on terms and push deals through the pipeline. We also know that although many lenders prioritise brokers in their business’s early stages, many will focus on direct deals as they grow.

At 365 Finance, we pride ourselves on being very broker-focused – something we have always been since we started in 2012. We believe that real relationships are important, which is why we build rapport with brokers over time and have a high level of repeat business.

Since 2012, we have worked with over 500 brokers and maintained a relationship with over 70% of them. Over 90% of the brokers we work with submit regular business to us, which is why the broker channel is our largest channel at 365 Finance.

Last year, 280 brokers generated new business, enabling over 1,700 small businesses to access the funds needed to keep their operations running smoothly. Without the relationships we’ve built with our brokers, we wouldn’t have been able to support so many businesses.

Why Does 365 Finance Like Working With Brokers?

We’re proud to say we are a broker-focused lender, but why do lenders like working with brokers?

Brokers are an extremely important part of the lending process; you’re able to pre-qualify clients, educate borrowers and streamline the entire process. Brokers are strategic channels, and we have built our business around you and your needs.

You may be under pressure, but with the right support, you can thrive. If you’re worried about any of the topics we’ve discussed in this article or want to talk to a member of our team directly, get in touch with our partnerships team.

At 365 Finance, we provide revenue-based funding of £10,000 to £500,000 in capital so your customers can thrive all year round. We collaborate with thousands of UK brokerages, providing unsecured finance solutions to small businesses – and market-beating commissions for you as an introducer.

To find out more, please contact a member of our partnerships team or head to our website.