Cash Accounting vs Accrual Basis Accounting

Written by Team 365 finance

Understanding your incoming revenue and outgoing expenses (as well as having well-organised finances) is critical to the success of any business. Decent accounting skills are therefore essential for a small business owner — and yet around 60% of small business owners feel they aren’t very knowledgeable when it comes to accounting.

Fortunately, we’re here to help. To support your business and help you better understand your finances, we’re going to examine two common accounting models: cash accounting and accrual basis accounting. Improving your accounting knowledge can help you maintain a consistent cash flow for your business, which is the key to steady business growth.

Learning more about their differences can also help you shift between these two accounting models, which is a crucial step in your business development. As 365 finance CFO Adam Brown says:

Moving from cash to accrual accounting becomes a necessary step for any growing business. Accrual accounting enhances visibility and supports business owners in maintaining sufficient liquidity to address BAU expenses alongside unforeseen events. Building an understanding of accounting can be an intimidating prospect but the benefits to business outcomes are potentially significant.

Adam Brown , CFO

Read on to learn more about these two accounting models, the difference between them, and which one is right for your business.

What are Accruals?

An accrual is an amount of money that you know is going to leave or enter your business, but has not yet been spent. For instance:

- Outgoing accruals: Examples include money owed to suppliers, salaries yet to be paid to employees, or taxes due to the government.

- Incoming accruals: Examples include payments due from your customers, or refunds due from suppliers.

Tracking accruals is a key part of accrual basis accounting (more on that below). Our first vital accounting tip is that even if you’re using an alternative accounting model, make sure you are aware of your accruals. Keeping an eye on your accruals can give you a peek into the financial future of your business. Losing track of them might mean forgetting to pay a bill or chase a client up for a payment.

Types of Accruals

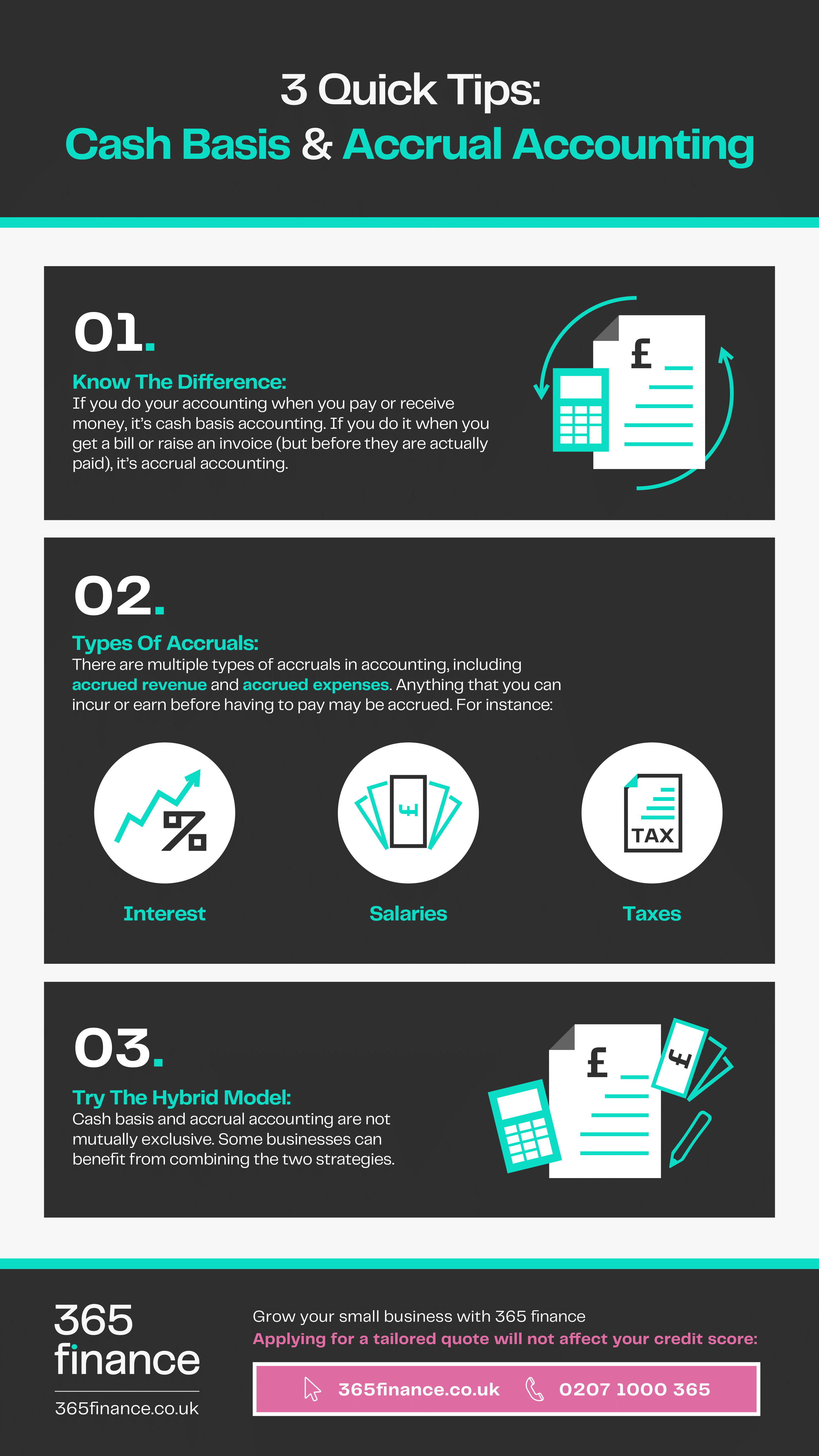

There are multiple types of accrual in accounting. The two most common types are accrued revenue and accrued expense, but anything that you can incur or earn before having to pay may be accrued. For example, interest, salaries, and taxes can all appear in your balance sheet as accruals.

Below, we’ve listed a few of the more common types of accruals, and provided an example of how you might encounter these accruals while reviewing your own finances.

Revenue

Accrued revenue is one of the most common types of accrual: any incoming cash that’s owed to your business but has not yet been paid is accrued revenue. With the modern trend towards subscription and SaaS business models, it’s becoming increasingly common for a business to accrue a significant amount of revenue without it actually being paid to them.

Example: Subscriptions are a very common form of accrued revenue, because they’re typically paid on a monthly basis but the payment date may not always align with a company’s end-of-month accounting.

If a subscription business acquires 100 new customers on the 10th of January (whose first payment of £10 is due on the 10th of February), then the business would mark down £1000 of accrued revenue at the end of January — as a service has been provided, but not yet paid for.

Expenses

Accrued expenses are the other most common type of accrual. It’s essentially the opposite of accrued revenue: any cash that’s due to leave your business, but has not yet been paid out yet is an accrued expense. The term can also be used to collectively refer to several other accrual types (including accrued salaries or taxes).

Example: Most accrued expenses start with an invoice, like those a consultant might send. A consultant might provide their services starting in June (and explain the price for those services), but might not send an invoice until three months later in September. In this example, you would track the amount the consultant is due as an accrued expense from June until September.

Interest

Expenses and revenue may accrue interest over time before they are paid. However, if this interest is only paid occasionally, it may end up as an accrual before it’s properly received and recorded as an asset. This can be referred to as a type of accrued revenue.

Example: A company holds a bond worth £2000 that yields 10% interest semi-annually. If the interest payment date is in May, but the company’s financial year ends in April, then the end-of-year report would show £200 of accrued interest.

Salaries

Employee salaries are very often recorded as an accrual because salary payments are almost always paid periodically, such as on a monthly or biweekly basis. Employees earn their salary as they work, but until payments are made at the end of the month, that money is treated as an accrued expense.

Salaries are a very important accrual to track, as failing to pay the exact amount you owe your employees is a serious violation of employment laws.

Example: Most businesses prepare their financial statements on the last day of every month. In this example, the employees of the business are paid weekly on Fridays for the hours they worked from the previous week, Sunday through to Saturday.

Assuming it’s Monday on the 31st of March, they will have last been paid on Friday the 28th for the hours worked through to Saturday 22nd. So, as of the 31st (when the financial statement is created), the employees will be due payment for the hours worked from the 23rd until the 30th. The payments that are due should be tracked on the financial statements as accrued salaries.

Taxes

Accrued taxes are another very important accrual to track, as failing to pay taxes that you owe (or paying the incorrect amount of taxes) is a significant offence. In fact, it can lead to your business being audited — a common challenge for business startups.

Example: On the UK government webpage for understanding your self-assessment tax bill, there is an excellent example of accrued taxes:

Your bill for the 2021-22 tax year is £3,000. You made two payments of £900 each (£1,800 in total) on account towards this bill in 2021, so the total tax to pay by 31 January 2023 is £2,700. This includes your remaining payment of £1,200 for the 2021-22 tax year, as well as the first payment on account of £1,500 towards your 2022-23 tax bill.

Although it’s not directly mentioned in the example HMRC provides, the payment of £1,200 due for the 2021-22 tax year should be recorded in your financial statements as accrued taxes, as it is owed but not yet paid.

Accrual Basis Accounting vs Cash Basis Accounting

So, how do accruals factor into your accounting? And if you don’t want to use accruals, how does the alternative (cash accounting, also known as cash basis accounting) work?

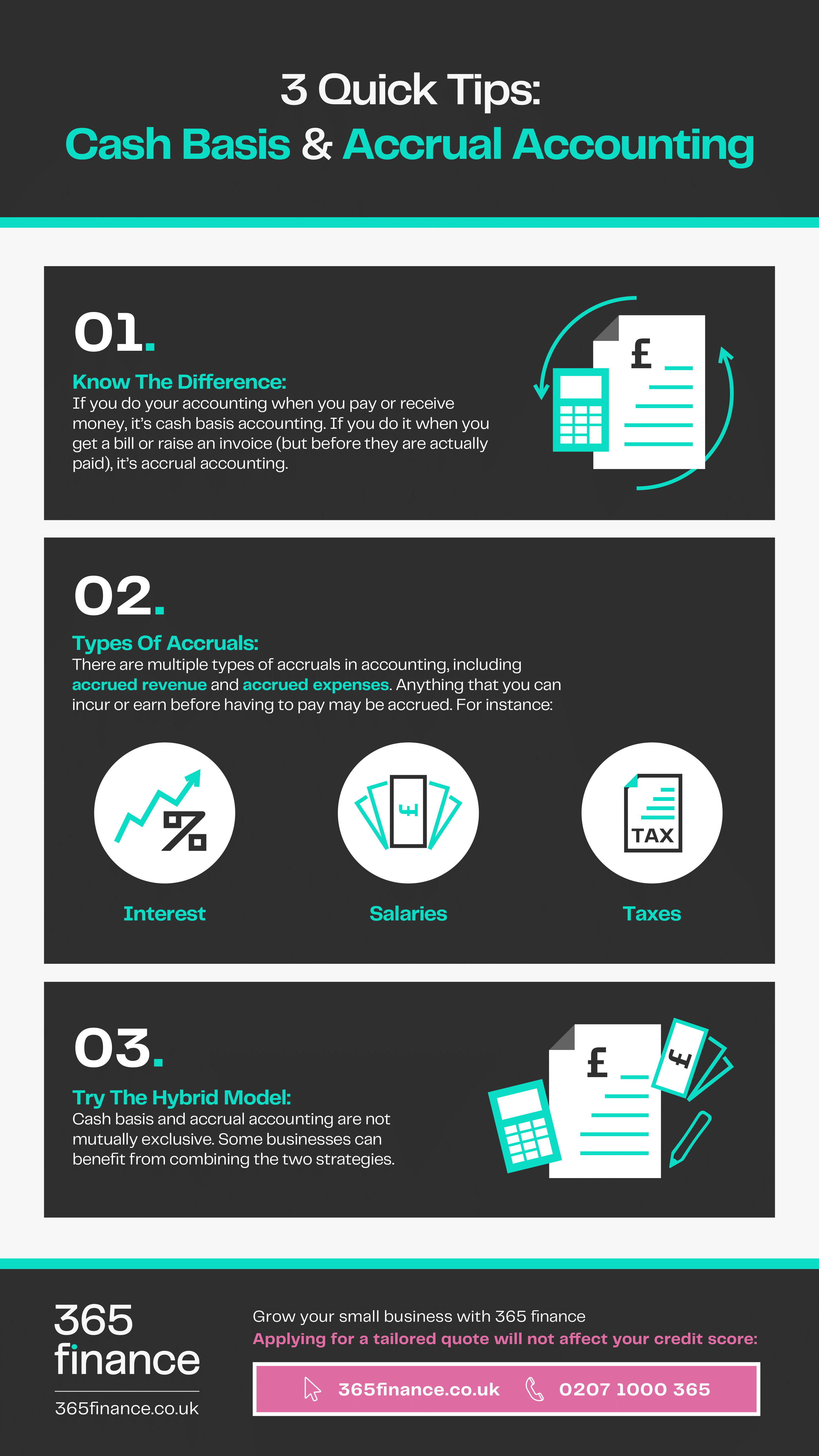

We’ll explain below, but it’s important to first understand that the key difference between these two accounting models is timing. If you do your accounting when you pay or receive money, it’s cash accounting. If you do it when you get a bill or raise an invoice (but before they are actually paid), it’s accrual basis accounting.

What is Accrual Accounting?

Accrual accounting is an accounting model in which revenue and expenses are recognised when they are earned or incurred rather than when payments are made. Put simply, it means using your accruals for your accounting rather than the actual payments you’ve made and received.

It’s based on the matching principle, which essentially means that all revenue and expenses within a set period must be reported and then ‘matched’ to determine profits and losses for that period.

The primary benefit of this accounting model is that it can provide your business with a more accurate picture of its financial wellbeing because it takes into account all transactions your business is involved in, not just the ones where money has actually changed hands. If you are primarily paid through invoices, or you have debts that you need to track, accrual accounting is a better way of staying on top of your finances.

Additionally, accrual accounting gives a better idea of the financial future of your business, as you’ll be recording many expenses and incoming payments ahead of time, rather than reactively adding them to your financial statements after they’ve been paid.

However, there are also downsides to accrual accounting. It can be more complex than cash accounting, because you need to track far more transactions. So, if you don’t have a strong understanding of accounting or a background in finance, accrual accounting may not be for you. Making mistakes when preparing your financial statements can be very dangerous for a business, as it may lead to poor financial decisions.

Additionally, the accrual method doesn’t provide a very accurate picture of the cash flow of your business. Since you’re tracking income that’s still to be paid, your income statement might show a huge amount of income from sales, but you don’t actually have that money to hand. In fact, depending on how you manage your accrual accounting, you might not receive the cash for a few months when the customer clears their invoice.

Accrual accounting is generally used by businesses that need to purchase inventory — in fact, it’s practically required for these businesses to use accrual accounting. They will purchase inventory and match the expense of buying that stock with potential sales revenue. Accrual accounting is also typically used by larger companies that can employ an accountant (or a team of them) to counteract the complexity of tracking accruals.

What is Cash Accounting?

Cash accounting (also known as cash basis accounting) is an alternative accounting model where you don’t need to track accruals, regardless of whether they are expenses or revenue. You’ll only ever track actual transactions where money has changed hands.

For example, whereas with accrual accounting you would record a loss of money when you receive an invoice, with cash accounting you would only record the expense when you actually pay the invoice.

While accrual accounting may seem like the obvious best choice — because it provides a more holistic view of your financial dealings — there are also some key advantages of using cash accounting.

One benefit is that it allows a business to know how much cash is available to them in real time. With accrual accounting, you’re tracking transactions that may not occur for months, to the extent that the accruals may obscure your current financial status. With cash accounting, you get a very clear and up-to-date image of your cash flow

Another advantage of cash accounting is its simplicity. With accrual accounting, you need to keep an eye on every single one of the accrual types we listed earlier. With cash accounting, you can simplify everything down to revenue and expenses.

However, the simplicity of cash accounting is also one of its disadvantages. The simplicity of this model can lead to an inaccurate picture of your financial status: because you’re not tracking transactions that are yet to occur, you may think your business is highly profitable, when you actually have a significant number of debts to pay.

Another disadvantage of cash accounting is that without looking ahead at future transactions, you won’t find it as easy to identify financial trends within your business or predict your future cash flow. If you’re trying to grow your business, being able to forecast your potential income is essential.

Because it’s easy to learn and easy to do, cash basis accounting is typically a favourite of small businesses. However, keep in mind that there are rules about who can use cash basis accounting. The HMRC will not let you use cash basis accounting if:

- Your business makes over £150,000 a year

- You are registered as a limited company or limited liability partnership

- You are on the list of business types provided on the HMRC cash accounting page

If your business grows during the tax year to exceed £150,000 in annual turnover, you can still use cash accounting until you hit £400,000 turnover. Using cash accounting when it’s not permitted for your business can lead to fines from HMRC. However, performing accurate accounting for a business with a high turnover practically requires the use of accrual accounting. So, it’s likely you will have swapped over by the time it is required.

What’s Right for My Business? Can I Use Both?

We’ve already mentioned some of the situations where one of the accounting models is better than the other:

- Accrual accounting is better for large businesses or businesses that purchase stock ahead of time.

- Cash accounting is a simple option for small businesses.

Every business’ needs differ. The two key factors to consider when picking an accounting model are the size of your company and the immediacy of your transactions (i.e. if you deal with a lot of transactions where cash is not exchanged immediately). You also need to follow the HMRC rules on cash accounting, as businesses in your industry may be legally obligated to use accrual accounting.

However, cash basis and accrual accounting are not mutually exclusive. Some businesses can benefit from combining the two strategies.

Also referred to as modified accrual accounting or hybrid accounting, this third model allows small businesses to maximise cash flow while still getting a complete picture of their financial status. The key factor in the hybrid model is VAT: if your company’s VAT-taxable turnover is less than £1.35 million, you can still file VAT accounts on a cash basis.

In accrual accounting, you might buy £500 of materials and pay £100 of VAT on them, then invoice your customer £800 plus £200 of VAT. All those transactions would need to be recorded in your financial statements — which means you’re effectively dealing with a large materials expenditure plus a big income tax payment all at once.

However, with the hybrid model, you can use cash accounting for your VAT accounts. So although the £100 VAT for the materials purchase would still need to be paid, the £200 VAT on the invoice can be delayed until the invoice is paid and cash actually changes hands.

You would still need to use accrual accounting for your other transactions (expenses, salaries, and so on) but VAT accounts can be dealt with using the cash basis model, which helps you space out your expenditures and maximise cash flow.

Fund Accounting Support or Training with 365 finance

The accounting models we’ve explained can be complex to put into practice, especially if you don’t have any formal training with bookkeeping. As such, you may want to invest in accounting training or hire an accountant to help you manage your finances. However, you may be concerned about the costs of either of these options.

With 365 finance, you don’t have to worry about funding you r new and improved bookkeeping system. Our Rev&U product allows fast and easy access to funding for any business investments you need to make, including a new accountant. As a revenue-based finance option, Rev&U is low-risk and comes without the pressure of high monthly payments.

r new and improved bookkeeping system. Our Rev&U product allows fast and easy access to funding for any business investments you need to make, including a new accountant. As a revenue-based finance option, Rev&U is low-risk and comes without the pressure of high monthly payments.

At 365 finance, we can provide both long and short-term financial solutions, with revenue-based funding available from £10,000 to £400,000 in capital. Apply for Rev&U today without affecting your credit score, or speak to our team to find out how we can help your business. To find out more, head to our website.