Business Loans for Pubs

The smart way to finance your pub’s growth, without the delays and rigid repayments of traditional bank loans.

Running a pub or bar comes with unique financial challenges. As a pub owner or operator, you might be looking to refurbish your premises, introduce a food menu, or simply keep cash flowing through the quieter months. The problem is that the options you’re most likely aware of, like traditional business loans, often don’t fit the bill. They’re slow, rigid, and rarely built for the realities of running a hospitality business. Which is why you need funding that’s fast, flexible, and works with your cash flow, not against it.

That’s exactly what you get with 365 Finance. You get access to a merchant cash advance which provides a fast, flexible alternative to a traditional bank loan. This gives you quick access to working capital to help you manage day-to-day costs, pay suppliers on time, and stay in control of cash flow during quieter periods.

Raise between

£10,000 & £500,000

Over

90% approval

Approval within

24 hours

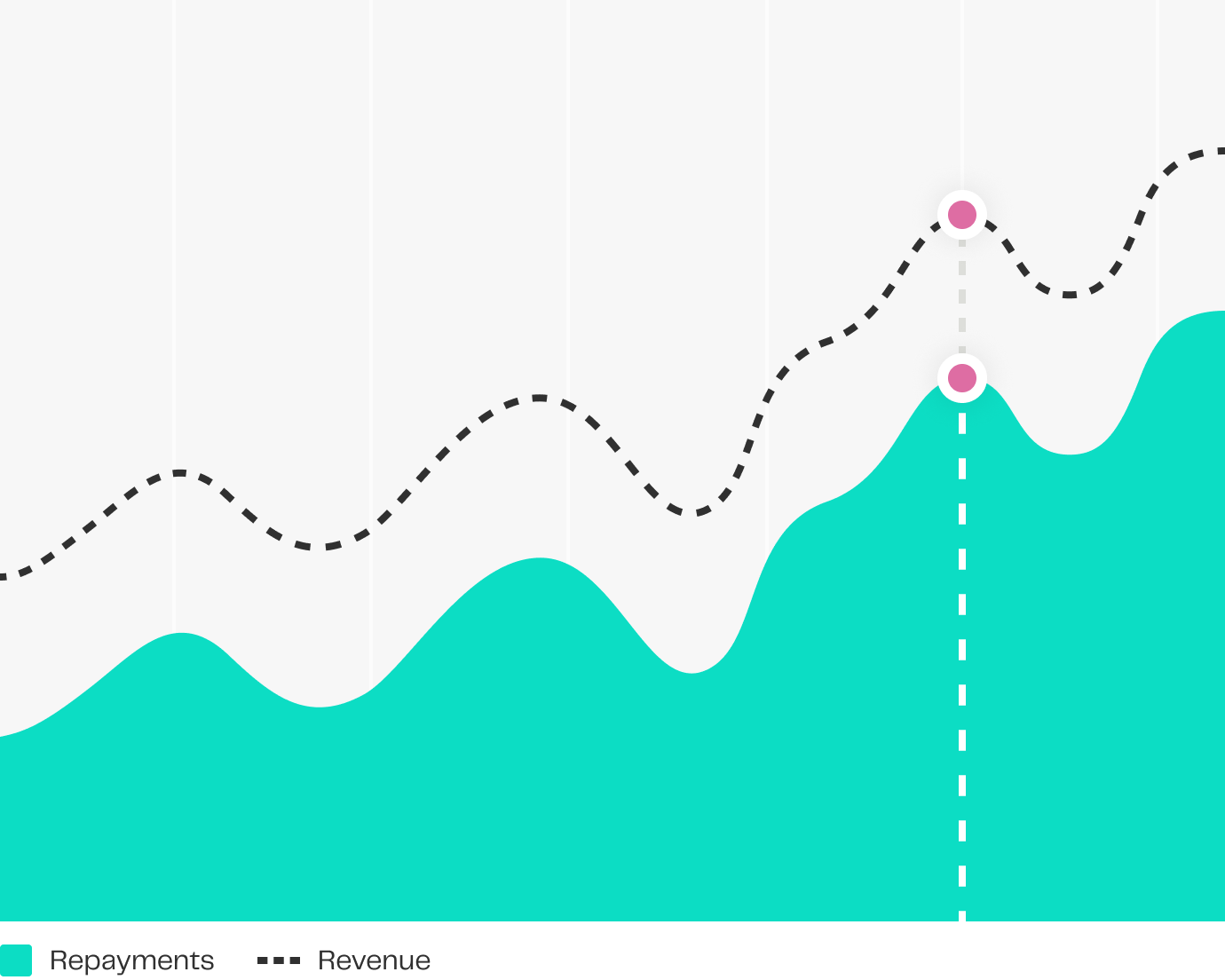

Unlike a traditional loan, repayments mirror the ups and downs of your business.

Repayments are automatic and based on a small percentage of your monthly card sales. So when business is slow, repayments are low – and when business is good, you pay a bit more. Not only does this remove the stress of a traditional high street loan, it is also perfect for seasonal businesses.

How Revenue-Based Finance repayments work

1

Agree fixed percentage

We agree a fixed percentage of your credit and debit card sales to repay the business cash advance (typically between 5% and 15% of your card sales).

2

Make card sales

You sell to your customers on your credit and debit card terminals as usual.

3

Repay automatically

The pre-agreed percentage is automatically deducted from your daily transactions at point of sale.

4

Receive money in your account

There is no change to the time it takes for you to receive the remaining money from your sales.

5

Reduce balance outstanding

The daily amount deducted reduces the balance outstanding on the cash advance.

6

Stop automatically

Collections stop automatically once the cash advance has been repaid in full.

Am I eligible for Revenue-Based Finance?

Has your business been trading for a minimum of 6 months?

Does your business’ monthly credit and debit card sales exceed £10,000?

You’re eligible

Get a quoteYou must take at least £10,000 per month in card sales and have been trading for at least 6 months

Request a callbackHow much capital does your pub or bar need?

Use our calculator and see how revenue-based financing could help your business:

£60,000

funding received

£100

for every card transaction

85% = £85

goes to your account

15% = £15

goes to 365 finance

How Pubs and Bars Have Benefitted From Revenue Based Finance

Pub owners and operators across the UK are turning to merchant cash advances for pubs and bars for financing opportunities that traditional lending often can’t support.

Our revenue-based finance model has helped businesses like yours invest where it matters most:

- Refurbishing tired interiors or outdoor spaces

- Upgrading or expanding food service alongside drink sales.

- Covering rising energy and supplier costs.

- Running local marketing campaigns to drive footfall and promote events.

- Purchasing or renewing a lease to secure long-term stability.

- Converting unused rooms into guest accommodation for additional revenue.

- Boosting working capital to stay resilient through quieter months or unexpected costs.

A simple and secure way to finance your business

Quick application process

Complete the application form. It takes less than 5 minutes!

Relationship manager

Be allocated a relationship manager to assist with any queries.

Approval in under 24 hours

Find out in up to 24 hours whether you’ve been approved or not.

Get your cash advance in days

Receive the funds direct into your business bank account within days.

Current Landscape for Pubs and Bars

Running a pub is hard, especially in today’s economic climate. And the numbers prove just that. Since 2000, the UK has lost over 20,000 pubs, falling from roughly 68,000 to 45,000 today.

The British Beer and Pub Association puts the number at about six pubs closing every week.

And the reasons for these closures are clear: soaring energy bills, rising staff costs, and changing customer preferences. To make matters worse, getting business loans for bars from traditional banks has become almost impossible, which only fuels the crisis.

High street lenders want extensive financial histories, personal guarantees, and collateral. Their application processes drag on for months. And even if approved, their fixed monthly repayments don’t care whether you’ve had a quiet Tuesday or a packed weekend.

That’s exactly why 365 Finance exists. We provide fast, flexible finance for pubs. You get the funding you need in days, not months, and we only take a percentage of your daily card sales, so repayments flex with your revenue.

“We’re proud to help pubs and bars access the finance they need to thrive. Traditional lending often fails hospitality businesses, but at 365 Finance, we understand the unique challenges you face and provide funding that genuinely works for your business model.”

Warren Abbey , CEO, 365 Finance

Useful information

Frequently asked questions

Revenue-based finance enables you to quickly and easily raise between £10,000 and £500,000. Unlike a regular bank loan, there are no fixed monthly payments – you simply pay back a small percentage of your credit and debit card sales, meaning you only pay us back when your customers pay you.

There are no APRs, admin charges or late fees. So if you’re having a quiet month, your repayments automatically reduce, which helps you manage your cash flow.

We’ve designed our funding process to be fast, simple and hassle-free. This means you don’t need to supply business plans or security for revenue based funding. Once funded, the processing of repayments happens automatically, so there is no disruption to your business.

You can apply in minutes, with approval within 24 hours (and a 90% approval rate). No security or business plans are required and flexible repayments are based on your card sales.

Unlike a bank loan, there are no fixed weekly or monthly repayments; you simply pay back a small percentage of your credit and debit card sales. This means that, during a seasonal dip in sales, your repayments will go down to match the decreased in sales – so your cash flow remains stable.

Finance Academy

Explore our Finance Academy to understand all the financial acronyms and jargon, and take charge of your business’s financial success today!

Explore our guides