Fast, reliable funding built around how pubs really work.

Pub Finance: Business Loans For Pubs and Bars

The smart way to finance your pub’s growth, without the delays and rigid repayments of traditional bank loans.

Running a pub or bar comes with unique financial challenges. As a pub owner or operator, you might be looking to refurbish your premises, introduce a food menu, or simply keep cash flowing through the quieter months. The problem is that the options you’re most likely aware of, like traditional business loans, often don’t fit the bill. They’re slow, rigid, and rarely built for the realities of running a hospitality business. Which is why you need funding that’s fast, flexible, and works with your cash flow, not against it.

That’s exactly what you get with 365 Finance. You get access to a merchant cash advance which provides a fast, flexible alternative to a traditional bank loan. This gives you quick access to working capital to help you manage day-to-day costs, pay suppliers on time, and stay in control of cash flow during quieter periods.

Raise Between

£10,000 & £500,000

Over

90% approval

Approval Within

24 hours

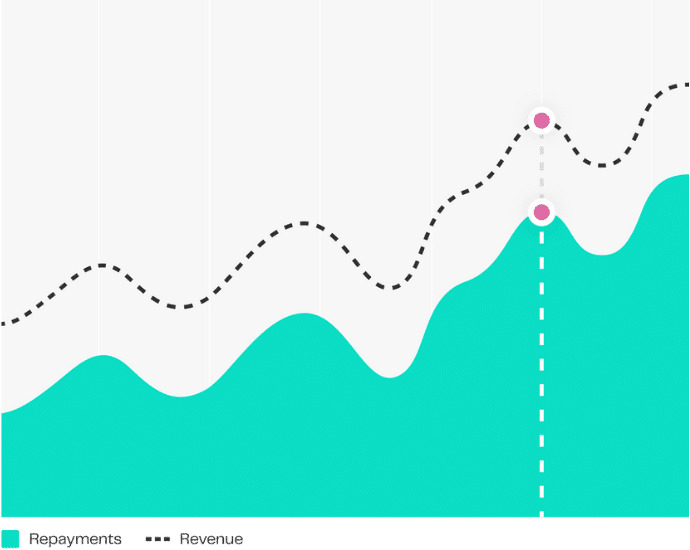

Unlike a traditional loan, repayments mirror the ups and downs of your business.

Repayments are automatically taken as a small percentage of your daily card sales. So when business is slow, repayments are low, and when trade picks up, you simply pay a bit more. This means you’ll never face the stress of meeting tight payment deadlines, which is perfect for pubs and bars where revenue naturally fluctuates with seasons, events, and economic conditions.

How revenue-based finance repayments work

1

Agree fixed percentage

Agree a fixed percentage of your credit and debit card sales to repay the business cash advance (typically between 5% and 15% of your card sales)

2

Make card sales

Sell to your customers on your credit and debit card terminals.

3

Automatic repayments

The pre-agreed percentage is automatically deducted from your daily transactions at point of sale and you will.

4

Get money into your account

This is automated so there is no change to the time it takes for you to receive your money.

5

Daily sales reduce balance outstanding

The daily amount deducted then reduces the balance outstanding on the business cash advance.

6

Collections stop automatically

Collections stop automatically once the cash advance has been repaid in full.

How much money does your pub or bar need?

£60,000

funding received

£100

for every card transaction

85% = £85

goes to your account

15% = £15

goes to 365 finance

Am I eligible for Reveue-Based Finance

Has your business been trading for a minimum of 6 months?

Does your business’ monthly credit and debit card sales exceed £10,000?

You’re eligible!

Get a QuoteYou must take at least £10,000 per month in card sales and have been trading for at least 6 months

Request a CallbackHow pubs and bars have benefitted from revenue based finance

- Refurbishing tired interiors or outdoor spaces.

- Upgrading or expanding food service alongside drink sales.

- Covering rising energy and supplier costs.

- Running local marketing campaigns to drive footfall and promote events.

- Purchasing or renewing a lease to secure long-term stability.

- Converting unused rooms into guest accommodation for additional revenue.

- Boosting working capital to stay resilient through quieter months or unexpected costs.

A simple and secure way to finance your business

Apply in minutes

Complete the application form. It takes less than 5 minutes!

Relationship manager

Be allocated a relationship manager to assist with any queries.

Approval under 24h

A decision will be made under 24h.

Get your cash advance in days

Funding directly into your business bank account within days

Current landscape for pubs and bars

Running a pub is hard, especially in today’s economic climate. And the numbers prove just that. Since 2000, the UK has lost over 20,000 pubs, falling from roughly 68,000 to 45,000 today.

The British Beer and Pub Association puts the number at about six pubs closing every week.

And the reasons for these closures are clear: soaring energy bills, rising staff costs, and changing customer preferences. To make matters worse, getting business loans for bars from traditional banks has become almost impossible, which only fuels the crisis.

High street lenders want extensive financial histories, personal guarantees, and collateral. Their application processes drag on for months. And even if approved, their fixed monthly repayments don’t care whether you’ve had a quiet Tuesday or a packed weekend.

That’s exactly why 365 Finance exists. We provide fast, flexible finance for pubs. You get the funding you need in days, not months, and we only take a percentage of your daily card sales, so repayments flex with your revenue.

Our Customers’ Stories

We’re proud to help pubs and bars access the finance they need to thrive. Traditional lending often fails hospitality businesses, but at 365 Finance, we understand the unique challenges you face and provide funding that genuinely works for your business model.

Warren Abbey , CEO, 365 Finance

Useful information

Accelerating Growth on All Types of Businesses

Frequently Asked Questions

Yes, absolutely. Your experience level isn’t what matters most. What matters most to us is to see that you’re trading successfully. What this means is that, for you to be eligible, you must be making at least £10,000 per month in card sales and have been trading in the UK for at least 6 months. So, whether you’ve recently taken on your first pub or bar, or you’re an experienced licensee, we assess applications based on your current business performance and card transaction history rather than your personal history in the industry. In fact, many first-time pub operators have successfully secured business loans for pubs and bars through 365 Finance, whether that’s for bar equipment financing, refurbishments, or working capital.

Our pub finance solutions are flexible and can be used for virtually any legitimate business purpose, including refurbishments, renovations, and pub equipment financing. We don’t restrict how you use the money, we trust you to invest it where your business needs it most. In the past, pub owners have used our funding to transform interiors, upgrade kitchen equipment to add food service, convert spare rooms into guest accommodation, install outdoor dining areas, or simply boost working capital during quieter months. To clarify, the application process remains the same regardless of your intended use, and you’ll receive the full amount to deploy as you see fit.

Yes. However, we don’t offer separate “stock loans” or “working capital loans”. 365 cash advance is one flexible funding solution that you can use however your business needs it. Whether that’s purchasing drinks for your inventory, covering supplier invoices, managing payroll during slower periods, or building up stock ahead of busy seasons, the choice is entirely yours. The best part? Our revenue-based repayment model is designed so that you’re not stretched thin when paying back the loan while simultaneously trying to maintain stock levels. How? Well, repayments adjust to your daily card takings, so you always have room to breathe.

In many cases, yes. If you’ve taken on debt or a high-interest merchant cash advance that’s putting pressure on your cash flow, our pub business loans can help you consolidate what you owe into a single, manageable repayment. Refinancing can make day-to-day money management easier by replacing multiple repayments with one revenue-based arrangement that moves in line with your sales, helping you maintain a healthier cash flow. That said, eligibility depends on your specific situation and any existing agreements you may have. The best way to know for sure is to speak with our team. We’ll take a look at your setup and help you decide whether refinancing is the right move for your business.

We take a realistic approach to credit history. We typically run soft credit checks as part of our assessment, because we don’t need or expect perfect credit scores. We also understand that many pub and bar owners have faced tough times, especially in recent years, and we focus on how your business is performing now rather than what happened in the past. Our main requirements are simple: you must have been trading for at least six months, take a minimum of £10,000 per month in card sales, and process payments via card transactions. We look at your recent trading figures and card payment data to assess affordability, which means we can often approve applications that traditional banks would turn down.

Definitely. If your pub or bar has more than one director or partner, all relevant people can be included in the application. It’s not classed as a joint application since the funding goes under a business name, but everyone involved in running the business can still be part of the process. In some cases, we might even recommend this. For example, if the main applicant is young or has limited credit history, we may ask another director to be added to help strengthen the application and improve the chances of approval.

Absolutely. In fact, this is precisely why our revenue-based finance model exists. Traditional business loans for pubs often create problems for seasonal businesses because they demand the same fixed repayment regardless of your takings. 365 cash advances for pubs and bars work differently: we only take an agreed percentage of your daily card sales, which means repayments automatically adjust to your revenue. If you operate a beer garden that’s packed in summer but quieter in winter, or you’re in a tourist area with distinct peak and off-peak seasons, our financing for pubs flexes with these fluctuations. How? Well, you pay more when you earn more, and less when trade is slower. This makes our funding particularly suitable for businesses with variable or seasonal income patterns.

Finance Academy

Explore our in-depth guides to help business understand 365 Finance.